Types of Annuities

There are three main types of annuities: fixed annuities, fixed index annuities and variable annuities. Annuities can also be classified as immediate or deferred, indicating when you will begin receiving annuity payments. Your personal goals and objectives will help determine the best type of annuity for you.

Key Takeaways

- Annuities can be classified by how they grow over time and how their payments are received.

- The main types of annuities are fixed, variable and indexed.

- Each type of annuity has its own level of risk and payout options.

Main Types of Annuities

There are several different ways to categorize the different types of annuities. One of the most popular classifications is based on how the annuity grows in value.

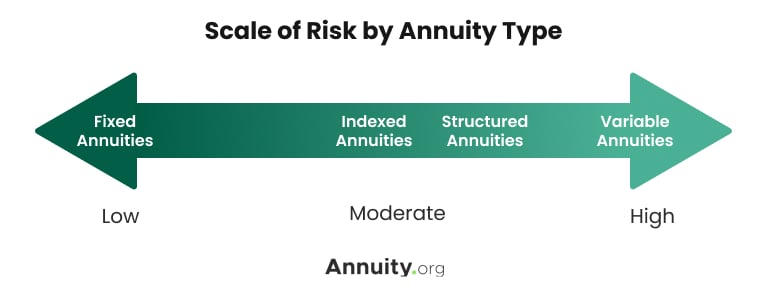

Fixed, variable and fixed index are the main types of annuities based on growth. You will have to consider your level of risk aversion — how you weigh preserving your investment against the potential for higher returns — when choosing.

Types of Annuities Based on Growth Potential

Taking the time to know and understand the different types of annuities can help you make a more informed purchase decision.

How Annuity Growth Impacts Interest-Rate Risk

The type of growth your annuity contract uses comes with a degree of risk. Generally, the more predictable your annuity’s growth is, the lower the risk. However, lower risk also means your growth potential will likely be somewhat limited.

In terms of annuity types, fixed annuities carry the least risk and tend to have lower potential returns. The main interest-rate risk with a fixed annuity is missing out on a better rate down the line, as Nate Nead told Annuity.org. Nead is the managing principal at Invest.net and a FINRA Series 63 license holder.

“If interest rates start going up during this time, new fixed annuities with higher rates might be more appealing to folks than existing ones — leading to potentially lower returns for current fixed-annuity holders,” Nead said.

Variable annuities have a higher potential for growth but come with an increased risk. “Interest rates don’t have quite as direct an effect on variable annuity investments, but they still matter since they do impact changes throughout general market conditions and the overall investment environment,” said Nead.

Fixed index annuities carry a moderate level of risk and a somewhat predictable return. Because they are also based on equity market growth, interest rates can indirectly influence the performance of indexed annuities through changes in market conditions, including inflation.

| Type | Interest | Risk | Reward |

| Fixed | Preset/guaranteed | Low | Predictable |

| Variable | Tied to an investment portfolio | High | Potentially higher or lower |

| Fixed Index | Preset minimum rate that can change according to the stock market index | Medium | Won’t sink below a set level |

How soon are you retiring?

Types of Annuities by Payout Options

Defining annuities by payout can mean two different things. You can categorize annuities either by when you begin to receive payments or by how long you’ll receive payments from the annuity.

When defining annuities by when payments start, the two types are immediate and deferred.

Types of Annuities Based on When Payments Begin

Typically, annuity payouts are used to protect against longevity risk. Annuities can provide guaranteed lifetime income, so you don’t outlive your retirement savings. But you can also arrange for an annuity to pay out over a fixed period of time.

Annuities can also be classified by how long payments are guaranteed. The four main types of annuities based on payout length are fixed-period, straight life, life with period certain and joint and survivor annuities.

Fixed-period annuities are the most straightforward. This type of annuity spreads out payments over a fixed period, typically for 20 or 30 years. With these annuities, the age and health of the annuity holder do not affect the amount of the payments.

A straight life annuity, also known as a lifetime annuity, guarantees annuity payments for a person’s lifetime. The person whose life expectancy the annuity is based on is known as the annuitant. The annuitant’s age and health are used to calculate the amount paid out each month.

Lifetime annuities are one of the most popular annuity types because they guarantee you will not outlive the income the annuity provides. Even if the total of the payments you’ve received exceeds the value of the annuity, you’ll continue to receive payments as long as you live.

Life with period certain annuities also promise payments for the annuitant’s lifetime but have some extra features. The period certain feature means that payments are guaranteed for a period of time, usually for 10 to 20 years, even if the annuitant passes away before the period elapses.

If that happens, the remaining years of payments will be made to the beneficiary named in the annuity contract. But if the annuitant lives beyond the period certain term, they will continue to receive payments throughout their lifetime.

The final type of annuity payout is a joint and survivor annuity. These annuities are most often used by married couples who want to set up an income stream that will last both their lifetimes.

A joint and survivor annuity continues payments for the remainder of two people’s lives. After the primary annuitant passes away, payments continue to be made to the surviving secondary annuitant. The IRS dictates payments made to the survivor must be no less than 50% and no more than 100% of the amount paid to the first annuitant.

Types of Annuities by Premium

Options for purchasing a deferred annuity include with a single lump-sum premium or a series of payments over time.

Single premium annuities, as the name suggests, are purchased with a single lump-sum premium. One of the more common products that use this option is a single premium immediate annuity (SPIA).

A SPIA allows you to make a single lump-sum payment and begin collecting a steady income stream in less than 12 months. It’s also called an immediate annuity or income annuity. They account for about 10% of annuities sold each year and are preferred by people close to retirement age.

Two types of annuities accept multiple premium payments. The first is known as a flexible premium annuity. All flexible premium annuities are deferred annuities, allowing you to make payments over a long period of time with the promise of a payout in the future. Some may allow you the flexibility to contribute without a schedule or a minimum number of routine payments.

The other kind of annuity with multiple premium payments is called a periodic premium annuity. With a periodic premium annuity, you make payments at regular intervals, such as monthly or quarterly.

“You’ll continue making these payments until either reaching a certain accumulation value or for a specified period, such as five years,” said Nead. “Periodic premium payment is often associated with deferred annuities that include systematic withdrawal plans.”

Read More: First-Time Annuity Buyers

Other Annuity Choices

A wide variety of annuities exist beyond the most common types. These can be tailored to your specific needs and long-term financial goals.

There are options that allow you to take advantage of tax breaks for qualified retirement accounts, such as traditional IRAs and 401(k) plans. You can also set up annuities to continue payments to beneficiaries after you die.

Other options include:

Lock In Fixed Annuity Rates as High as 6.4%

Finding the Right Type of Annuity for You

There are pros and cons to each type of annuity. You should consider how the features of different types of annuities work best for your current financial situation and how each can help you reach your long-term financial goals.

You should also compare several different annuity options, ask yourself how each meets your needs and talk to a financial professional about how each annuity you’re considering will help you achieve your goals.

Checklist for Choosing the Best Annuity for You

Earn up to $6K Annual Interest on a $100K Annuity

Common Questions About Types of Annuities

There are several ways to categorize annuities by type. Annuity.org categorizes the types of annuities by payout, growth and premium options. These tend to be the most common aspects of annuities that people consider important when buying an annuity.

The main types of annuities are fixed, variable and fixed index annuities. Fixed annuities guarantee a fixed interest rate on your contributions over a period of time. Variable annuities provide a return based on the performance of their subaccounts. Fixed index annuities base their payments on the performance of market indices such as the S&P 500 or Dow Jones Industrial Average.

The best type of annuity varies from person to person. The type of annuity that is best suited for you depends on your current financial situation and long-term financial goals for an annuity. It is important to compare annuities to find the one that best fits your needs and goals. You should consider how you wish to pay for an annuity, the kind of growth you want an annuity to accomplish and the type of payout that suits your financial goals.