Indexed Annuities

An indexed annuity, also known as a fixed-index annuity or an equity-indexed annuity, credits interest based on two factors: a minimum guaranteed rate and additional returns based on the performance of a market index. People often refer to indexed annuities as hybrids of fixed and variable annuities.

Key Takeaways

- An indexed annuity provides a rate of return based on the performance of a market index like the S&P 500.

- Indexed annuities guarantee a minimum interest rate and you don’t lose money even if the market underperforms.

- The issuing insurance company can cap your gains to protect itself from losses.

What Is an Indexed Annuity?

An indexed annuity is a financial product whose terms are defined by a contract between you and an insurance company. It features characteristics of both fixed annuities and variable annuities. Indexed annuities are also referred to as index annuities, fixed-index annuities or equity-indexed annuities.

Indexed annuities offer a minimum guaranteed interest rate combined with a rate tied to a broad stock market index, such as the S&P 500 or the Dow Jones Industrial Average.

This unique hybrid design offers protection against stock market losses, as well as the potential to profit from the market’s gains.

If you are thinking about buying an indexed annuity, make sure you understand how growth is credited to your account. You may have a minimum guaranteed return, but your upside will be capped as well.

How Does an Indexed Annuity Work?

Indexed annuities work by crediting interest based on the performance of an underlying index. The interest that indexed annuities earn is usually credited at the end of the annuity’s term, which typically ranges from three to 15 years.

You can customize your annuity contract by selecting the index on which to base your annuity’s interest. The most common index options include the S&P 500, the Nasdaq 100 and the Russell 2000.

Calculating Interest on an Indexed Annuity

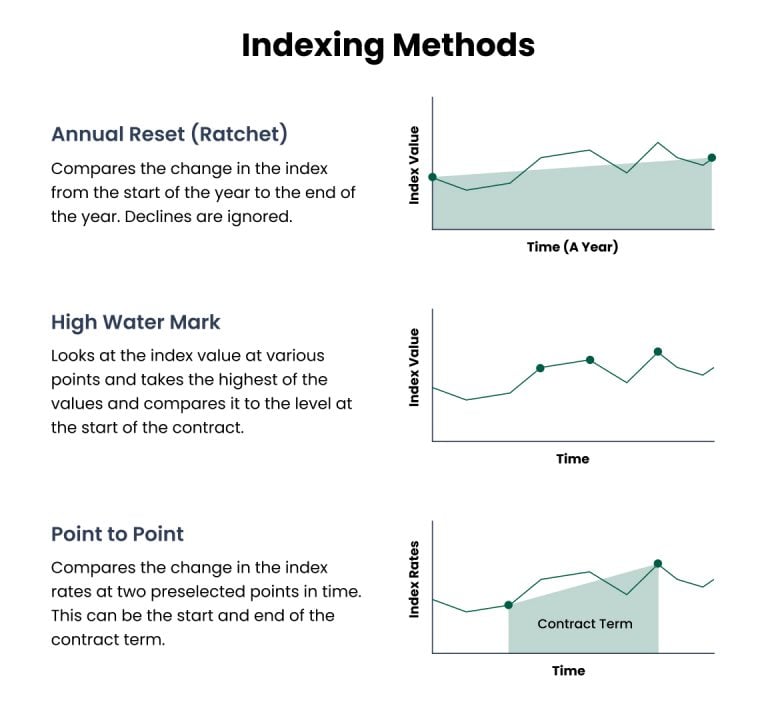

Different providers calculate interest on an indexed annuity in a variety of ways. According to the Institute of Business & Finance, there are three main methods of calculating indexed annuity interest.

Indexing Methods for Annuities

- Annual reset (ratchet)

- High-water mark

- Point-to-point

As the name suggests, in an annual reset, or ratchet, contract, interest is credited once per year. The interest is calculated by comparing the change in the index from the start of the year to the end of the year, but only in years when the index has a gain.

With both the high-water mark method and the point-to-point method, interest is credited at the end of the contract term. However, gains are determined differently with each method.

In a high-water mark contract, gains are determined by subtracting the beginning index value from its highest anniversary date value over the entire term. In a point-to-point contract, gains are determined by subtracting the beginning index value from the ending index value.

Using Index Averaging in Interest Calculations

In addition to understanding indexing methods, it is also important to know how insurers use index averaging in interest calculations. According to the Institute of Business & Finance, over 75% of indexed annuities include an averaging feature.

Averaging can be used in different ways depending on the structure of the contract. In a point-to-point contract, for example, the insurer might use the average of the last year of the contract to compare to the beginning contract value.

Averaging generally means that indexed annuity customers will never receive interest based on the highest point of the index value, but also that they will never be credited interest based on the lowest point of the term.

Three in 4 indexed annuities include an averaging feature.

Indexed Annuity Yields

Besides indexing methods, there are other contract provisions that go into calculating the interest on your indexed annuity. According to the Financial Industry Regulatory Authority (FINRA), the computation may typically involve three factors.

Factors That Can Impact Index Rate

Guaranteed Minimum Return

Indexed annuities guarantee a minimum return that’s credited at the end of the contract’s surrender period. This means that when you buy an indexed annuity, you’re guaranteed to receive at least a certain amount of return on your investment.

The most common guaranteed minimum return for an indexed annuity is 3% of 90% of the amount invested, according to the Institute of Business & Finance.

If your index performs consistently well, you have the potential to earn a higher return than traditional fixed annuities.

On the other hand, if the stock index underperforms, your payments will not fall below a preordained level.

The guaranteed minimum return helps make indexed annuities a more reliable source of income. Many people use indexed annuities to set up an income stream that allows them to maintain a comfortable lifestyle in retirement.

How soon are you retiring?

What Are the Fees and Commissions Associated With Indexed Annuities?

Like any other type of annuity, indexed annuities come with fees that must be paid on top of the initial premium. The more complex an annuity is, the more expensive the fees tend to be.

The most common fee associated with indexed annuities is the administration fee or annual fee. This is a fixed percentage subtracted from any index increase before it’s credited to the account. The administration fee does not affect the minimum guaranteed rate of the contract.

Some indexed annuities also charge a spread fee, also known as a margin fee or asset fee, to control how much of the index’s returns are credited to the annuity. The spread fee is subtracted from the gains that the index earns.

A 4% spread fee might reduce a 12% index gain to just 8% growth credited to the annuity’s value.

Because indexed annuities are not as simple as fixed annuities or income annuities, they tend to have higher commissions. The commission on an indexed annuity can range from 6% to 8%, compared to the 1% to 3% commission you can expect for a fixed annuity. However, the commissions are typically baked into the cost of the annuity contract.

Who Should Get an Indexed Annuity?

Indexed annuities are best suited for investors who don’t need the money right away. According to licensed financial advisor Chip Stapleton, indexed annuities are most beneficial for investors with 10 to 15 years before they’ll need income because they’ll have time to weather any downturns that might reduce the annuity’s return.

Most indexed annuities have some downside protection, said Stapleton, who is a FINRA Series 7 and Series 66 license holder and CFA Level II candidate.

“It might even be a floor of zero, so you’re never going to lose money,” Stapleton told Annuity.org. “But then your upside is also capped there too, so if you want to limit your bad, you also have to limit your good.”

Case Study: When an Indexed Annuity Is a Good Fit

The hypothetical case study below provides an example of how someone about to retire can benefit from the features of an indexed annuity. It is not intended as financial advice.

Name: Hallie

Age: 65

Looking to Invest: $100,000

- Hallie is looking for a way to generate guaranteed income to supplement her Social Security checks.

- She has considered purchasing bonds, but with low interest rates, a large bond investment won’t keep pace with inflation.

![]() Best Option: Indexed Annuity

Best Option: Indexed Annuity

Indexed annuities offer a low-risk way to generate predictable income.

Client Profile: Hallie, 65, is nearing retirement and is looking for a way to generate guaranteed income to supplement her Social Security checks.

Background: She wants to add some flexibility to the conservative part of her portfolio. She considered purchasing bonds, but she’s worried a large bond investment won’t keep pace with inflation.

Conclusion: An indexed annuity is a good fit for someone like Hallie because these annuities offer a low-risk way to generate predictable income. She’s guaranteed not to lose money, so it’s a lower-risk investment compared to a variable annuity that would expose her to downturns in the stock market.

Indexed Annuity Pros and Cons

Like any investment, indexed annuities have their benefits and costs. Since they are essentially a hybrid of fixed and variable annuities, they carry a mixture of pros and cons. They have the potential for higher returns without the risk of losing your money. Because these annuities are complicated, they can be difficult to understand.

Pros & Cons of Indexed Annuities

Pros

- Tax-deferred growth

- When your index performs well, your contract value increases

- Principal protection from market downturns

- Minimum guaranteed rate

- May hedge against inflation

- Rates may be better than CDs

Cons

- Gains are capped

- Steep surrender charges

- Spread fees may reduce market gains

- Contracts can be complex

Lock In Fixed Annuity Rates as High as 6.4%

Frequently Asked Questions About Indexed Annuities

Indexed annuities are not securities and do not earn interest based on specific investments. Rather, indexed annuity rates fluctuate in relation to a specific index, such as the S&P 500. In contrast to variable annuities, indexed annuities are guaranteed not to lose money.

Indexed annuities guarantee that you won’t lose money. If the index is positive, then you are credited a certain amount of interest based on your participation rate. If the market tanks, you’ll receive a fixed rate of return — or no loss of your original principal instead.

The advantages of indexed annuities include the potential to earn more interest and the premium protection they offer. The disadvantages include complex contracts and caps on gains.

A balanced retirement portfolio requires a mix of assets with varying degrees of risk. Because indexed annuities are inherently balanced — having features of both fixed and variable annuities — these products can be included in a portfolio without skewing asset allocation.

Indexed annuities are not as safe as fixed annuities, but they are safer than variable annuities. The guaranteed minimum return ensures that an indexed annuity’s value won’t fall below the amount specified in the contract.