Annuities-What Is an Annuity?

Annuities are powerful financial instruments designed to provide guaranteed income for life. Whether you’re planning for retirement, seeking long-term financial security or aiming to diversify your investment portfolio, annuities offer a customizable solution tailored to you. Discover how annuities can help secure your financial future.

Key Takeaways

- An annuity is an insurance product designed to provide consumers with guaranteed income for life.

- The type of annuity you purchase determines your future annuity payments.

- The primary benefits of buying an annuity include principal protection, the potential for guaranteed lifetime income and the option to leave money to your beneficiaries. Some annuities may also be optimized to help pay for long-term care.

- Annuities can help cover essential retirement expenses that may not be covered by Social Security. This financial security guarantees lifetime income, and protects your principal, ensuring peace of mind in retirement.

What Is an Annuity?

An annuity is a customizable contract issued by an insurance company that converts an investor’s premiums into a guaranteed, fixed income stream.

More specifically, an annuity contract is a legally binding, written agreement between you and the annuity provider that issues the contract. This contract transfers your longevity risk — the risk of you outliving your savings — to the insurance company. In exchange, you pay premiums as outlined in the contract.

“Annuities can be a great tool to help you generate retirement income or reach other financial goals, but there are many kinds of annuities. It’s important that you understand how they work to know if one is right for you.”

Many retirees need more than Social Security and investment savings to provide for their daily needs. Annuities provide individuals with a way to potentially accumulate wealth, defer taxes, preserve their principal and ensure a reliable income stream in retirement.

How Do Annuities Work?

At their most basic, annuities work by converting a premium into a stream of payments. The amount and duration of the payments depend on various factors, including the type of annuity, the premium amount, the annuitant’s age and the chosen payout option.

Annuities can be optimized for income or long-term growth, but they are not short-term investment strategies. Most annuities supply income through a process of accumulation and annuitization. The exception is immediate annuities that begin paying out as soon as within a month of purchase with no accumulation phase necessary.

When you buy a deferred annuity, you pay a premium to the insurance company. That initial investment grows tax-deferred throughout the accumulation phase, typically anywhere from five to 30 years based on the terms of your contract. Once the annuitization, or distribution, phase begins — again, based on the terms of your contract — you start receiving regular payments.

Annuity contracts transfer all the risk of a down market to the insurance company. This means you, the annuity owner, are protected from market risk and longevity risk. To offset this risk, insurance companies charge fees for investment management, contract riders, and other administrative services. In addition, most annuity contracts include surrender periods during which the contract holder cannot withdraw money from the annuity without incurring a surrender charge.

Furthermore, insurance companies generally impose caps, spreads and participation rates on indexed annuities, each of which can reduce your return.

Other features of annuities:

- Riders

- Death benefits

- Living benefits

- Fees and commissions

- Taxation

- Free-Look Period

Types of Annuities

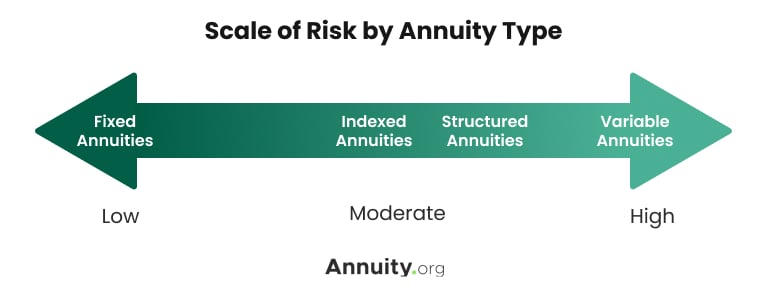

Different types of annuities exist to fit the diverse needs of the market. Your personal goals and objectives will determine the type of annuity that is right for you.

GUARANTEED INCOME

Fixed Annuities

- Earns a guaranteed rate of interest for a set period of time

- Rate of interest may be guaranteed for a set period of time or may fluctuate from anniversary to anniversary

- Backed by the insurance company that issued it

GROWTH POTENTIAL

Fixed Indexed Annuities

- Earns interest based on a market index, such as the S&P 500

- Doesn’t participate directly in the stock market and preserves premium

- Guaranteed minimum rate of return

FLEXIBLE INCOME

Variable Annuities

- Earns interest through investments you select within the annuity

- Does not guarantee a return but offers more growth potential

Read More: The Cost of Waiting for Interest Rates to Rise

How Are Annuity Rates Set?

Annuity rates are set differently depending on the type of annuity. For example, an issuing insurance company sets the rate for its fixed annuities and will guarantee this rate for a defined period, usually between three and 10 years.

Rate setting is more complicated for other kinds of annuity contracts whose interest rates may vary throughout the term of the contract. A fixed index annuity, for example, has both a fixed rate and a rate tied to the growth of an equity market index. The indexed rate may be set according to several factors, including rate caps and floors, to keep it within a specified range.

How Are Annuities Taxed?

Finance professionals widely recommend annuities to their clients for their tax-deferred growth potential. Once you purchase the annuity, your investment grows tax-free for the length of the contract. You won’t owe taxes until you start receiving payments when the annuity matures.

How much of that payout is taxed depends on the type of annuity. If you own a qualified annuity, you’ll pay income taxes on the full withdrawal amount. Only the earnings are taxed on non-qualified annuity withdrawals.

You can even transfer your annuity’s value to a new annuity contract without triggering any taxation. As long as the contract’s value is transferred directly through the annuity provider (or providers) and not cashed out, you won’t be taxed on the transfer. This process is known as a 1035 exchange.

How Do Annuities Pay Out?

Annuities can be structured for immediate or deferred payout. When considering an annuity, you must first define your financial goals and when you want to start receiving annuity payments.

If you want to begin receiving annuity payments within a year or less, you will choose an immediate annuity. Alternatively, if you’d rather set your payments to begin at some point in the future, you will purchase a deferred annuity and specify the start date in your contract.

INCOME NOW

Immediate Annuities

- Funded with a single lump-sum payment

- Guaranteed monthly payouts

- Supplement your retirement savings

INCOME LATER

Deferred Annuities

- Funded with a single payment or multiple payments

- Savings accumulate interest, then convert to income

- Supplement your retirement savings

Read More: How Much Does A $100,000 Annuity Pay Per Month?

Annuity Fees

The fees associated with annuity contracts vary widely depending on the provider and the type of annuity. Most annuities do not charge annual fees, but build commissions into the contract.

“An annuity is a type of insurance, and the salesperson will get a commission for selling the policy,” Bill Ryze, a chartered financial consultant, told Annuity.org.

In general, the simpler an annuity contract is, the fewer fees it will carry and the lower its commission will be. Commissions typically range from 1% to 10% of the contract value and may come in the form of a one-time fee or as a recurring, “stream” commission structure.

Annuity Surrender Charges

Deferred annuities usually come with surrender charges. The surrender charge is similar to the early withdrawal penalty on a certificate of deposit (CD). Each annuity contract has a different surrender period, usually in the range of two to 10 years. If you withdraw money from an annuity during the surrender period, you’ll be charged a percentage of the annuity’s total value.

Surrender charges typically decrease the further you get into the surrender period. An annuity might charge an 8% penalty in the first and second years, a 7% penalty in the third year, a 6% penalty in the fourth year, and so on.

Variable Annuity Fees

Variable annuities tend to have the most fees. This is because variable annuities are among the most complex annuity contracts and require the insurer to manage the multiple subaccounts in which the annuity premium is invested.

Common variable annuity fees:

- Administrative fees

- Mortality and expense risk charge

- Underlying fund expenses

- Rider fees and charges

- Penalties

Source: U.S. Securities and Exchange Commission

Reasons To Buy an Annuity

People buy annuities to create long-term income. While most often considered financial solutions for older people who are close to retirement, annuities can benefit investors of any age with a variety of financial goals.

Reasons to buy an annuity include:

- Long-term security

- Tax-deferred growth

- Principal protection

- Probate-free estate distribution

- Inflation adjustments

- Death benefits for heirs

The best reason to choose an annuity is to create peace of mind that your money will provide you with lifetime income.

— Stephen Kates, Certified Financial Planner® professional

Income annuities are generally suitable for people who are within a year of retirement and want the security of guaranteed income, or for younger people who have inherited a large sum of money and wish to protect the windfall from poor financial management.

In contrast, deferred annuities are generally not recommended for people who have short-term financial needs or younger people with more aggressive investment strategies.

Earn up to $6K Annual Interest on a $100K Annuity

Annuity Benefits

One of the key benefits of an annuity is that it allows the investor to save money without paying taxes on the interest until a later date. Annuities have no contribution limits, unlike 401(k)s and IRAs.

Another significant benefit of annuities is the creation of a predictable income stream to fund retirement. With an annuity, you don’t have to worry about outliving your savings. This is a major advantage in the post-pension age.

Your reasons for investing in an annuity should align with your unique lifestyle and financial situation.